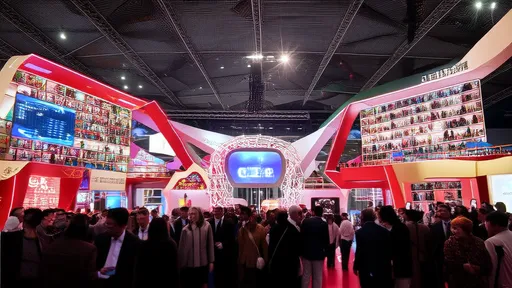

For the first time in its history, the Financial Street Forum Annual Conference has expanded its reach beyond China's borders, establishing international venues in global financial hubs including the United Arab Emirates and Frankfurt. This strategic move marks a significant evolution for the prestigious forum, traditionally a domestic powerhouse for financial dialogue, signaling its ambition to foster a more interconnected and globalized financial ecosystem. The enthusiastic participation from these key international centers underscores a growing, mutual interest in bridging Eastern and Western financial markets and policy frameworks.

The decision to launch overseas sessions did not emerge in a vacuum. It reflects a calculated response to the increasingly intertwined nature of the global economy, where financial stability and innovation in one region can have immediate ripple effects across the world. For years, the Financial Street Forum has served as a critical platform within China, bringing together regulators, institutional investors, and executives to debate and shape the future of finance. By planting its flag in the sands of the UAE and the heart of Europe's financial engine in Frankfurt, the forum is proactively creating conduits for dialogue that transcend time zones and regulatory jurisdictions. The initiative speaks to a broader vision of moving beyond siloed discussions to a more holistic, global conversation on the challenges and opportunities that lie ahead.

The choice of the United Arab Emirates, particularly hubs like Abu Dhabi and Dubai, as a partner location is a masterstroke of strategic alignment. The UAE has aggressively positioned itself as a forward-looking financial nexus, not just for the Middle East but for the vast corridors of trade and investment connecting Asia, Africa, and Europe. Its embrace of fintech, sustainable finance, and digital assets resonates deeply with parallel initiatives being championed within China's own financial sector. The sessions held there are expected to dive deep into topics like cross-border investment flows, the infrastructure financing needs of the Belt and Road Initiative, and the convergence of Islamic finance with global standards. The palpable energy from Emirati financial institutions and sovereign wealth funds indicates a shared desire to co-author the next chapter of international finance, rather than merely participate in it.

Similarly, the establishment of a分会场 in Frankfurt, Germany, carries profound symbolic and practical weight. As the home of the European Central Bank and a dense concentration of Europe's banking giants, Frankfurt represents the institutional bedrock of the Eurozone. Its participation signals a crucial channel for Sino-European financial diplomacy at a time of complex geopolitical currents. The discussions in Frankfurt are anticipated to be heavily focused on regulatory harmonization, green finance taxonomies, and the future of digital currencies. European banks and regulatory bodies see this as a vital opportunity to engage directly with their Chinese counterparts, aiming to build mutual understanding and create frameworks that can mitigate risks and foster cooperative ventures. In a post-Brexit landscape, Frankfurt's elevated role in European finance makes it an indispensable partner for any global forum with serious ambitions.

The content of these overseas sessions is meticulously crafted to reflect the unique financial landscapes of their host cities while maintaining the forum's core thematic pillars. Rather than being carbon copies of the Beijing agenda, each international venue will feature curated panels and keynotes that address region-specific priorities and pain points. In the UAE, for instance, a significant focus will be on asset management in emerging markets and the role of sovereign investment vehicles in stabilizing global capital markets. Concurrently, in Frankfurt, the dialogue will likely pivot towards systemic risk assessment and the integration of Environmental, Social, and Governance (ESG) criteria into mainstream banking and investment decisions. This tailored approach ensures that the discussions are not only relevant but also actionable for the local and international attendees.

The implications of this global expansion are multifaceted and far-reaching. On a practical level, it provides an unprecedented platform for direct, off-the-record dialogue between Chinese financial leaders and their international peers. In the often-opaque world of global finance, such facilitated conversations can pave the way for smoother negotiations, joint ventures, and a deeper appreciation of mutual constraints and objectives. Furthermore, it enhances the soft power and international prestige of China's financial sector, presenting it as an open, collaborative force eager to engage with global best practices and contribute to shaping international standards.

However, this ambitious international foray is not without its challenges. Navigating the complex web of international regulations, managing the expectations of diverse stakeholders, and ensuring that the dialogue translates into tangible outcomes will be the true test of this initiative's success. Critics may question whether such forums can move beyond high-level rhetoric to effect real policy change or market integration. The organizers are undoubtedly aware that the proof will be in the pudding—future cross-border deals, formalized cooperation agreements, and shared regulatory white papers that emerge from these connections will be the ultimate metrics of success.

Looking ahead, the successful launch of these international sessions sets a compelling precedent. It is highly plausible that future editions of the Financial Street Forum will see an even broader network of overseas venues, potentially incorporating financial centers in Southeast Asia, North America, and Africa. This model of a "distributed forum" could become a new gold standard for international financial conferences, combining the concentrated expertise of a primary location with the localized, on-the-ground insights of satellite hubs across the globe.

In conclusion, the inaugural overseas sessions of the Financial Street Forum in the UAE and Frankfurt represent much more than a simple change of venue. They are a bold statement of intent in an era of economic nationalism and fragmentation. By creating these new bridges for dialogue, the forum is betting on collaboration over isolation, on the free flow of ideas as the lifeblood of a healthy global financial system. The enthusiastic response from these global hubs suggests that this is a bet many are willing to take. The world will be watching closely to see what is built upon these new foundations.

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025