Against the backdrop of global economic uncertainty, the Financial Street Forum Annual Conference has drawn widespread attention for its focus on revitalizing China's private economy and exploring how capital can effectively nurture the fertile ground of technological innovation. The forum, held in Beijing's prestigious financial district, brought together policymakers, industry leaders, and financial experts to discuss the crucial relationship between private enterprises and technological advancement.

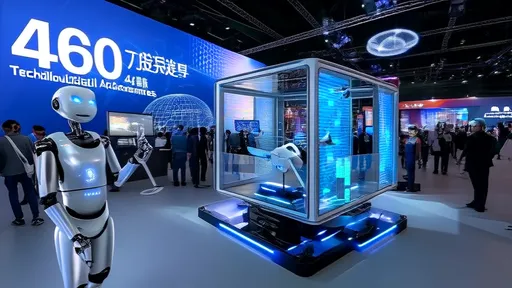

The discussions revealed a growing consensus that private enterprises have become the main drivers of technological innovation in China. Unlike state-owned enterprises, which often focus on large-scale infrastructure projects, private companies demonstrate remarkable agility in adapting to market changes and embracing disruptive technologies. Their ability to quickly pivot and experiment with new business models makes them ideal candidates for pioneering breakthroughs in fields like artificial intelligence, biotechnology, and clean energy.

Venture capital and private equity firms are increasingly recognizing the potential of China's tech startups, with investment in semiconductor companies, renewable energy ventures, and digital healthcare platforms reaching record levels this year. However, participants noted that the funding environment remains challenging for early-stage companies, particularly those working on fundamental research that may not yield immediate commercial returns.

The forum highlighted several successful cases where strategic capital injection transformed promising startups into global competitors. One particularly compelling example came from a Shenzhen-based robotics company that, with proper funding and mentorship, evolved from a university research project into a world leader in industrial automation. Such success stories demonstrate how targeted financial support can accelerate technological development and create valuable intellectual property.

Regulatory frameworks and policy support emerged as critical themes throughout the discussions. While participants acknowledged the government's efforts to create a more favorable environment for private enterprises, they emphasized the need for more transparent and consistent regulations. The uncertainty surrounding certain technology sectors, particularly those involving data security and cross-border operations, continues to pose challenges for investors and entrepreneurs alike.

Banking institutions presented new financial products specifically designed for technology companies, addressing the unique challenges these firms face. Traditional lending models often struggle to evaluate companies whose primary assets are intellectual property and human capital rather than physical collateral. The introduction of specialized valuation methods and risk assessment frameworks represents a significant step toward bridging this gap.

The relationship between universities, research institutions, and private enterprises received considerable attention. Several panel discussions explored how to improve the technology transfer process and create smoother pathways for academic research to reach commercial markets. The current system often leaves promising research stranded in laboratories due to funding shortages and bureaucratic hurdles.

International perspectives added depth to the conversations, with representatives from Silicon Valley, European tech hubs, and Southeast Asian markets sharing their experiences. The comparison revealed both similarities and differences in how various ecosystems support technological innovation through private capital. While China has made remarkable progress in certain areas, participants identified opportunities to learn from international best practices, particularly regarding patient capital for long-term research projects.

The role of stock markets in supporting tech companies generated lively debate. The recent performance of China's STAR Market and ChiNext Board suggests growing investor appetite for technology stocks, but questions remain about valuation methodologies and market stability. Some experts advocated for specialized listing requirements that better reflect the unique characteristics of technology companies, especially those in the early revenue stage.

Corporate governance emerged as another crucial factor in attracting investment. Investors increasingly scrutinize the management structures and decision-making processes of private companies before committing capital. Well-established governance frameworks not only reduce investment risk but also help companies navigate complex regulatory environments and scale their operations effectively.

The human capital aspect of technological innovation cannot be overlooked. Several sessions focused on talent development and retention strategies, recognizing that successful tech companies depend on attracting and nurturing skilled professionals. The competition for top talent has intensified across all technology sectors, with compensation packages and workplace culture becoming decisive factors for prospective employees.

Supply chain considerations featured prominently in discussions about manufacturing-focused tech companies. Recent global disruptions have highlighted the importance of resilient supply networks, and investors are increasingly evaluating how companies manage their production ecosystems. Companies that demonstrate robust supply chain management often enjoy valuation premiums compared to their less-prepared competitors.

Sustainability and environmental concerns are reshaping investment priorities across the technology landscape. Green technology companies, particularly those working on carbon capture, energy storage, and circular economy solutions, are attracting significant attention from impact investors. This trend reflects broader societal shifts toward environmentally conscious business practices and regulatory pressures to address climate change.

The digital transformation of traditional industries presents both challenges and opportunities for private enterprises. Companies that successfully help established businesses adopt new technologies stand to benefit substantially, but they must navigate complex legacy systems and resistance to change. The forum featured several case studies of successful digital transformation projects, highlighting the strategies that proved most effective.

Cross-border collaboration continues to play a vital role in technological advancement, despite increasing geopolitical tensions. Several speakers emphasized the importance of maintaining international research partnerships and knowledge sharing, particularly in areas like healthcare and climate science where global challenges require coordinated solutions. The financial sector has a responsibility to support these collaborations through specialized funding mechanisms.

Looking ahead, participants identified several emerging technology sectors that warrant particular attention from investors. Quantum computing, space technology, and advanced biotechnology were frequently mentioned as fields with tremendous potential for growth and innovation. These areas require substantial long-term investment but could yield transformative breakthroughs that reshape entire industries.

The forum concluded with a recognition that supporting private enterprises in technology sectors requires coordinated efforts across multiple stakeholders. Financial institutions, government agencies, research organizations, and industry associations must work together to create an ecosystem that nurtures innovation while managing risks appropriately. The success of these collaborative efforts will determine China's position in the global technology landscape for years to come.

As the discussions made clear, capital alone cannot guarantee technological success. The most effective approaches combine financial resources with mentorship, market access, regulatory support, and talent development. By taking this comprehensive view, stakeholders can ensure that capital truly serves as nourishment for the fertile ground of technological innovation rather than simply serving short-term financial objectives.

The insights from this year's Financial Street Forum Annual Conference will undoubtedly influence policy decisions and investment strategies in the coming months. The continued vitality of China's private sector, particularly in technology fields, depends on creating the right conditions for innovation to flourish. With careful planning and strategic investment, the country's technological ambitions appear well within reach.

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025